———- Court asks PTI founder to submit surety bond of Rs1 million

———- IHC CJ-led bench announces reserved verdict on bail plea

———- NAB had filed £190 million NCA reference in Dec last year

———- Khan to remain behind bars despite securing bail

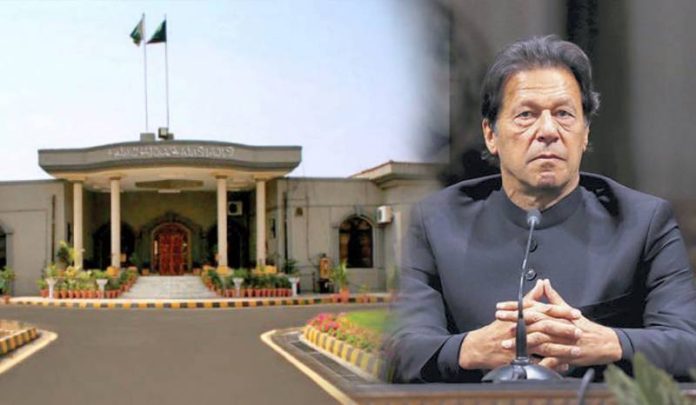

Islamabad: The Islamabad High Court (IHC) granted on Wednesday bail to PTI founder Imran Khan in the £190 mil-lion case.

The court asked the PTI founder to submit a surety bond of Rs1 million in order to secure bail. Howev-er, the order will not result in the ex-premier’s release from Adiala jail since his sentences in the Iddat and cypher cases are yet to be suspended.

A day earlier, a two-member bench comprising IHC Chief Justice Aamer Farooq and Justice Tariq Mehmood Jahangiri reserved the decision on Imran’s bail plea following the completion of arguments presented by both sides. Amjad Parvez, the special prosecutor of the National Accountability Bureau (NAB), contended that the funds should have been remitted to the government of Pakistan.

“The Supreme Court clearly stated in its verdict that the funds were mistakenly deposited into the Su-preme Court’s account. This act of secrecy constitutes a significant deception,” Parvez asserted.

Concluding his arguments, Parvez urged the court to expedite the trial proceedings rather than con-sidering bail at this stage.

Responding to the prosecution’s claims, Imran Khan’s lawyer, Sardar Latif Khosa, challenged the allega-tions, particularly those made by former aide Shahzad Akbar. Khosa questioned why Imran Khan was being held accountable for matters beyond his control.

Khosa highlighted that a witness of NAB acknowledged the absence of Imran Khan’s signature and af-firmed that no funds were directed to the PTI founder’s account or that of his wife, Bushra Bibi.

“Imran Khan and Bushra Bibi did not derive any personal benefit from these transactions,” Khosa em-phasised.

The case revolves around allegations of corruption and abuse of authority linked to a financial settle-ment during the PTI’s tenure, which reportedly incurred a £190 million loss to the national exchequer. –Agencies