China’s economy has managed to withstand pressures and achieved hard-won progress in the first three quarters of this year, with the country’s GDP growing 5.2 percent year on year during this period, according to data from the National Bureau of Statistics (NBS), released on October 20.

Since the beginning of this year, global economic growth has lacked momentum, trade protectionism has been on the rise and issues including geopolitical conflict and international trade friction have frequently occurred, an NBS spokesperson said during a press conference on the same day.

Moreover, for China, the adverse impacts of changes in the external environment have worsened, domestic effective demand remains insufficient and some enterprises are facing operational difficulties, posing weighty challenges to maintaining stable economic performance.

“In this context, China has achieved 5.2 percent economic growth, fully demonstrating its strong resilience and ability to adapt and break through difficulties in an unstable and uncertain environment,” the spokesperson said, adding that the growth rate ranks among the top of major economies worldwide, making China a consistently stable and reliable driver of global economic growth.

“Steady economic growth in the first three quarters has laid a solid foundation for achieving the full-year target, and there remain many favorable conditions for reaching the goal,” the spokesperson added. China’s full-year GDP growth target for 2025 is around 5 percent, a goal that was clearly outlined in the 2025 Government Work Report released in early March.

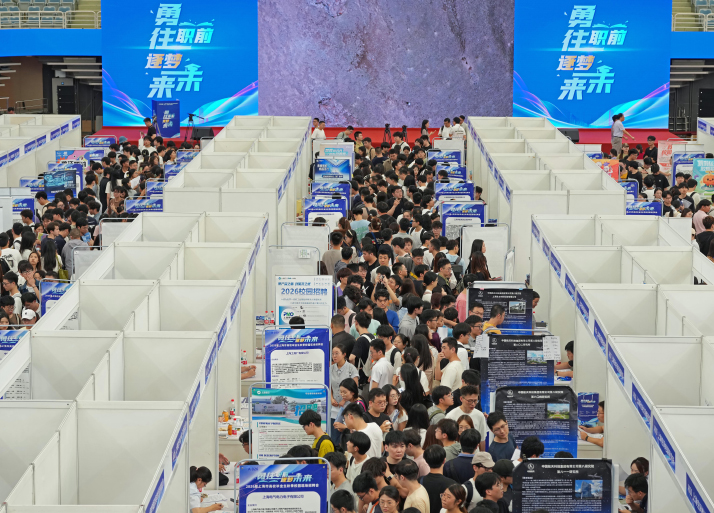

Boosting domestic demand

“Overall, the first three quarters have seen stable growth and steady employment. Domestic consumption and investment—the major sources of domestic demand—continue to play an active role in supporting economic growth,” Zhang Jianping, Deputy Director of the Academic Committee of the Beijing-based Chinese Academy of International Trade and Economic Cooperation, told Beijing Review.

According to the NBS, the surveyed urban unemployment rate averaged 5.2 percent in the first three quarters. This rate went down 0.1 percentage point from August to 5.2 percent in September. Furthermore, final consumption expenditure contributed 53.5 percent to economic growth, up 9 percentage points from last year, continuing to serve as the economy’s main driving force.

China has announced a raft of measures to expand the scope of its consumer goods trade-in program this year, including new subsidies for purchasing digital products like smartphones, tablets, smartwatches and wristbands, as well as the increased number of home appliance categories.

The consumer goods trade-in program stimulates domestic demand by incentivizing the replacement of old products with new, energy-efficient models. This initiative supports the country’s broader goals of high-quality economic growth, reduced environmental impact and upgraded consumption structure.

Earlier this year, China issued ultra-long-term special treasury bonds totaling 300 billion yuan ($42 billion) to support the program, compared with last year’s 150 billion yuan ($21 billion) allocated for the initiative.

This financial support has effectively boosted household consumption. For example, as of September 10, the number of applications for automobile trade-ins nationwide had exceeded 8.3 million, meaning that more than 30,000 people applied for a new car each day on average. The “old-for-new” program has also brought more high-quality products into people’s daily lives, with retail sales of energy-efficient appliances and smart home devices continuing to grow rapidly in the first three quarters.

China’s retail sales of consumer goods went up 4.5 percent year on year to nearly 36.59 trillion yuan ($5.13 trillion) in the first three quarters. In September, they rose 3 percent year on year to 4.2 trillion yuan ($589 billion).

“A stronger-than-expected outturn in recent quarters—reflecting front-loading in international trade and relatively robust domestic consumption supported by fiscal expansion in 2025—more than offset the headwinds from higher uncertainty and tariffs,” the International Monetary Fund (IMF) said of China’s growth prospects in its October World Economy Outlook report.

“In the fourth quarter, we can further expand domestic demand, particularly focusing on unlocking consumer market potential,” Zhang said. “We will build a diversified consumption landscape, foster a sound consumer market environment and ensure that our consumption subsidy policies are accurately implemented to deliver real benefits to consumers.”

Promoting new engines

Since the beginning of this year, many sectors have tailored the development of new quality productive forces to local conditions, continuously optimizing the economic structure and facilitating an orderly shift from old to new growth drivers.

New quality productive forces feature hi-tech, high efficiency and high quality, in line with the nation’s new development philosophy with a focus on innovative, coordinated, green and open development for all.

For example, industries such as large language AI models, robots, aerospace and autonomous driving have been continuously injecting fresh momentum into the country’s economic development.

In the first three quarters, output of industrial robots, service robots and high-speed train sets rose 29.8 percent, 16.3 percent and 8.6 percent, respectively.

In line with the major trend of green and low-carbon development, China has been briskly developing clean energy and focusing on the creation of new growth points in green development.

In the first three quarters, power generation from wind and solar energy by industrial

enterprises with an annual main business revenue of at least 20 million yuan ($2.8 million) both achieved double-digit year-on-year growth. Output of new-energy products, including new-energy vehicles, lithium-ion power batteries for automobiles and solar cells, increased 29.7 percent, 46.9 percent and 14 percent, respectively.

In 2024, national research and development (R&D) expenditure increased 8.9 percent year on year, and R&D intensity, which measures commitment to innovation and future growth rather than just the absolute amount of money spent, rose 0.11 percentage points compared with the previous year. Since the beginning of this year, several sectors have continued to boost innovation investment, mainly in emerging industries. In the first three quarters, investment in the automobile manufacturing sector, as well as in railway, shipbuilding, aerospace and other transportation equipment manufacturing, maintained double-digit year-on-year growth.

In terms of supporting investment, “we also need to find ways to reduce operating costs for private enterprises and stimulate their investment enthusiasm,” Zhang said.

Besides, emerging industries are thriving. New consumption models, including live-commerce, a combination of live-streaming and e-commerce, and social commerce, or the direct buying and selling of products or services within a social media platform, are growing rapidly, with related online retail sales in the first three quarters increasing 9.8 percent year on year.

Strengthening foreign trade

In April, when U.S. President Donald Trump shook global trade norms by announcing sweeping tariffs, the IMF trimmed its forecast for China’s growth by 0.6 percentage points in response to escalating China-U.S. trade frictions. By July, following a pause on higher rates in May, it revised the figure upward by 0.8 percentage points. Half a year after the tariff war began, the IMF projected in the October report that China’s economy would maintain the growth rate it predicted in July, 4.8 percent, and that it will slow down modestly next year.

Days earlier, the World Bank put China’s economy growth at 4.8 percent for 2025; in April it had forecast growth of 4 percent.

“The trade frictions between China and the U.S. are expected to persist for a long time. In the process of tension and struggle, China needs to work hard to keep differences in bilateral economic and trade relations under control, while also safeguarding the country’s interests through strategic efforts,” Zhang said.

“We need to reduce our dependence on the U.S. market and actively expand diversified foreign trade markets, with a particular emphasis on tapping the market potential of Belt and Road partner countries, especially those in the Association of South East Asian Nations (ASEAN), to support stable foreign trade and economic growth,” Zhang added. The China-proposed Belt and Road Initiative works to boost connectivity along and beyond the ancient Silk Road routes.

China’s total goods imports and exports in yuan-denominated terms rose to 33.61 trillion yuan ($4.71 trillion) in the first nine months of 2025, up 4 percent year on year, data from General Administration of Customs of China (GACC) showed on October 13.

During the same period, China’s goods trade with Belt and Road partner countries totaled 17.37 trillion yuan ($2.43 trillion), 6.2 percent higher than a year earlier, GACC data revealed. Trade with ASEAN, Latin American, African and Central Asian nations grew 9.6 percent, 3.9 percent, 19.5 percent and 16.7 percent year on year, respectively, while that with other economies

in the Asia-Pacific Economic Cooperation (APEC) increased 2 percent.

Zhang also advocated for fully leveraging the Regional Comprehensive Economic Partnership (RCEP)—a free trade pact among 15 Asia-Pacific nations including China, Japan, the Republic of Korea, Australia, New Zealand, and the 10 ASEAN member states. He emphasized harnessing the agreement’s trade creation effects and boosting mutual investment to drive trade growth.

“This includes accelerating enterprises’ overseas expansion and using two-way investment to strengthen cooperation in our supply and value chains, thereby steadily enhancing China’s industrial and foreign trade competitiveness,” he added.

China’s Economic Performance in Q1-Q3 2025

●GDP reached over 101.5 trillion yuan ($14.2 trillion), up 5.2 percent year on year.

●The tertiary industry expanded 5.4 percent year on year, outpacing a 3.8-percent increase of the primary industry and a 4.9-percent increase of the second industry.

●Value-added industrial output increased 6.2 percent compared to the same period last year.

●Value-added service output rose to nearly 59.3 trillion yuan ($8.3 trillion), accounting for 58.4 percent of GDP, 0.8 percentage points higher than that in the same period last year.

●Per-capita disposable income reached 32,509 yuan ($4,564), a 5.2-percent year-on-year increase after deducting price factors.

●Fixed assets investment dropped 0.5 percent year on year to about 37.2 trillion yuan ($5.2 trillion). –The Daily Mail-Beijing Review news exchange item