ISLAMABAD: Pakistan’s current account deficit (CAD) continually limits the government’s ability to maintain a free trade regime. However, the recent easing of import restrictions amidst the improving foreign exchange reserves will provide a cushion to the large-scale manufacturing (LSM) sector.

Younus Dagha, ex-federal finance secretary, said this while talking to WealthPK.

Import restrictions adversely affect the aggregate output in the LSM sector. This is due to the fact that the raw materials and intermediate goods used in the production process are imported from other countries, he said.

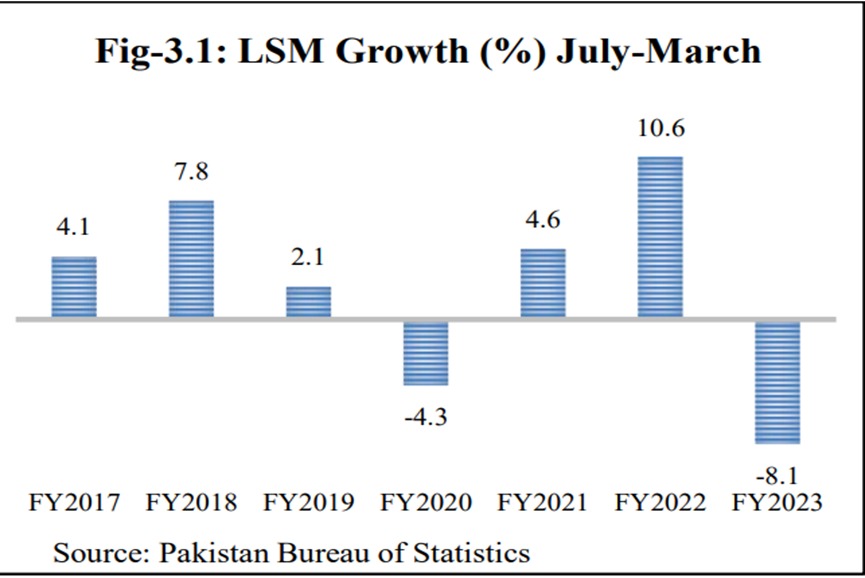

According to the Pakistan Economic Survey, from July to March of FY2023, the LSM sector experienced a negative growth rate of 8.11% compared to a positive growth of 10.61% in the corresponding period of the previous year.

Younus Dagha was of the view that by easing import restrictions, the manufacturers will be able to diversify their sources of inputs.

“This will enhance resilience in supply chains, reduce dependency on a single supplier or region, and mitigate the risks associated with disruptions in the supply of crucial materials,” he opined.

Highlighting the impact of import easing on the export-oriented LSM sector, he said, “Many industries, especially those involved in export-oriented manufacturing such as textile, furniture, and sports, were a part of global supply chains. Imports play a crucial role in these supply chains by connecting Pakistani manufacturers with global networks, fostering collaboration, and ensuring a smooth flow of goods across borders.”

Before the easing of import restrictions, some sectors showed negative growth rates, he asserted.

The overall negative growth was primarily observed in food (-1.62%), tobacco (-0.57%), textile (-3.16%), garments (2.94%), petroleum products (-0.68%), cement (-0.85%), pharmaceuticals (-1.30%), and automobiles (-1.85%).

However, wearing apparel, leather products, furniture, and others (football) demonstrated positive growth rates.

In a nutshell, the relaxation of import restrictions, coupled with a modest improvement in foreign exchange reserves, is expected to serve as a support mechanism for the LSM sector. –INP