Since the beginning of the year, China has seen economic progress both in terms of quantity and quality. Data from the National Bureau of Statistics (NBS) showed on April 16 that China’s GDP recorded a year-on-year growth of 5.3 percent in the first quarter (Q1) of 2024. The national economy got off to a good start, with accumulating positive factors laying a solid foundation for full-year growth target [of around 5 percent], NBS Deputy Commissioner Sheng Laiyun told a press conference on the same day in Beijing.

Shortly after China released its Q1 statistics, Singapore consumer bank DBS announced it would revise up its 2024 GDP growth forecast for China from 4.5 percent to 5 percent.

China’s Q1 expansion was driven by robust services sector growth and export demand. Additionally, domestic infrastructure and manufacturing investment accelerated thanks to proactive state initiatives, counteracting pressures from slowing property investment, according to DBS.

International institutions such as Goldman Sachs, Citibank, and the Asian Development Bank have also all revised their projections for China’s economic growth upward for this year, votes of confidence in China’s economic outlook.

While the numbers are certainly encouraging, Sheng emphasized the need to not only focus on changes in overall economic indicators but also to pay closer attention to the improvement of quality and efficiency when observing the Chinese economy.

“It’s essential to keep an eye on the effectiveness of the country’s economic structural adjustments and the progress of high-quality development,” Sheng added. He said China’s high-quality development had made new achievements in Q1 despite pressures and challenges both at home and abroad.

New quality

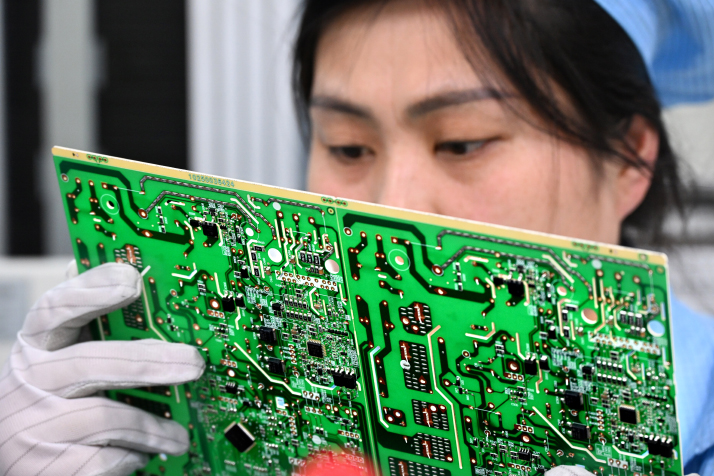

As economic recovery continued to gain momentum, China has made remarkable headway in fostering the development of new quality productive forces, which is high on this year’s agenda. In the larger context of China’s economic development, the concept of new quality productive forces refers to initiatives aimed at enhancing productivity, innovation, sustainability and quality in different sectors of the economy through technological innovation and digital transformation.

“Analysis of Q1 data reveals that the implemented policy measures are yielding positive results, while the development of new quality productive forces is demonstrating remarkable achievements across various industries, business activities, and product categories,” Sheng said.

New industries and products continued to grow. In Q1, the value-added output of hi-tech manufacturing enterprises with annual main business revenue of more than 20 million yuan ($2.76 million) increased by 7.5 percent year on year, up 2.6 percentage points from the fourth quarter of last year. The hi-tech services industry continued to maintain a rapid growth momentum, with the value-added output of information transmission, software and information technology services growing by 13.7 percent, up 2.5 percentage points from the fourth quarter of last year.

Building on the rapid growth of previous years, the first quarter saw a 29.2-percent growth in the production of new-energy vehicles, said the NBS. Solar cell production increased by 20.1 percent, and the growth rate of polysilicon and monocrystalline silicon, key components in the photovoltaic industry, remained at over 50 percent. China’s service robot production grew by 26.7 percent from the same period of 2023, while its output of semiconductor and 3D printing equipment saw double-digit growth.

New business models continued to emerge. The ongoing development and application of big data, the Internet, and the Internet of Things are driving changes in production methods. Online livestreaming and instant retail are particularly popular. According to the NBS, the online retail sales volume maintained double-digit growth, growing by 11.6 percent in Q1.

New investments and new infrastructure construction showed strong growth momentum. According to the NBS, investment in hi-tech industries increased by 11.4 percent year on year in Q1, up 1.1 percentage points from the previous year; investment in hi-tech services industries grew by 12.7 percent.

As of late February, 132,000 new 5G base stations had been built, bringing the total to over 3.5 million. In addition, new infrastructure including digital computing and fiber optic communication are also being implemented at a faster pace.

“New quality productive forces are continuously getting stronger through corporate transformation and upgrading,” Sheng said.

Looking ahead, it’s important to adapt to local conditions and, while carrying out the technological transformation and upgrading of traditional industries, it’s essential to cultivate emerging industries and future industries to promote the new quality productive forces as it is the biggest driving force for China’s economic transformation and high-quality development, he said.

Quality in the ‘troika’

In Q1, China demonstrated commendable performance from the perspective of investment, consumption and exports. Fixed assets investment rose 4.5 percent year on year, according to the NBS. Manufacturing investment became a buzzword as the sector grew by 9.9 percent year on year.

“Further breakdown within the manufacturing sector reveals a particularly noteworthy emphasis on investment in equipment renewal and upgrading,” Yang Daoling, a researcher at the Department of Big Data Development at the State Information Center (SIC), said at the a forum for discussing Q1 economic performance, hosted by China News Service on April 16.

The investment intensity index for manufacturing projects soared by 13.3 percent year on year in January to February and swiftly escalated by 40.6 percent in March, according to the SIC, which produces the index to reflect the national investment situation. And in March, data showed a 65.5-percent year-on-year growth in the index for projects related to equipment renewal and upgrading, surpassing the overall investment intensity growth rate in the manufacturing sector by nearly 25 percentage points.

“These projects primarily focus on areas such as electrical equipment transformation, safety facilities upgrading, and energy conservation improvements,” Yang said, adding that the remarkable growth underscores the effectiveness of policies aimed at promoting large-scale equipment renewal initiatives.

Guo Liyan, a researcher with the Chinese Academy of Macroeconomic Research, highlighted major investment trends at the forum.

“Currently, in the manufacturing sector, there is a continuous increase in investment toward transformation, upgrading and renovation, particularly focusing on high-end, green, and intelligent transformation,” Guo said. “This signifies the ongoing efforts to accelerate the growth of new drivers in our economy.”

In Q1, investment in hi-tech fields showed outstanding performance. Guo said the indicators speak volumes, indicating emerging industries, represented by hi-tech sectors, are gathering more resources including capital and talent.

Taking aerospace equipment manufacturing as an example, its investment growth exceeded 40 percent in Q1. Guo said the growth is inseparable from the efforts across various regions to promote the development of strategic emerging industries such as commercial aerospace.

Private investment was also a frequent topic at the forum. According to the NBS, private investment turned positive in Q1, achieving a growth rate of 0.5 percent. Particularly noteworthy is that after deducting real estate investment, private investment saw a year-on-year growth rate of 7.7 percent in Q1.

“The growth of private investment is related to a series of reform measures aimed at stimulating private investment vitality,” Guo said. The figures are the result of measures implemented to create more major projects and large-scale initiatives for private investment and offer better protection and services for those investments, she added.

The year-on-year decline of 9.5 percent in real estate investment in the first quarter exerted a certain drag on overall investment performance.

“In the short term, the real estate sector faces challenges; looking ahead, the future development of China’s real estate will differ from the past. While the emphasis used to be primarily on the quantity of buildings, there will be a shift from quantity to quality in the future,” Zhao Bo, Tenured Associate Professor of Economics at Peking University’s National School of Development, told the forum.

Retail sales of consumer goods climbed 4.7 percent year on year in Q1. Meanwhile, the year-on-year growth rate of services retail sales reached 10 percent, outpacing goods retail sales by almost 6 percentage points, according to the NBS.

“This gives a good picture of the upgrading and transformation of China’s consumption structure,” Guo said. “With services-oriented consumption expenditure accounting for over 45 percent of household consumption expenditure last year, and as the per-capita income level rises and the overall demand structure upgrades, the proportion of service consumption in total consumption expenditure will steadily increase.”

Since Q1, the market for new types of consumption powered by artificial intelligence, big data and other emerging technologies has been accelerating, Guo said. He also said households are becoming more interested in consumption that is environmentally friendly, healthy and safe.

In response to the preference for increased consumption quality, the consumer goods manufacturing industry is also undergoing transformation and upgrading, she added.

In Yang’s opinion, the performance of consumption in the cultural tourism, home appliance and consumer logistics sectors is most impressive.

Following the surge in ice-and-snow-related consumption in Harbin, Heilongjiang Province, earlier this year, Tianshui in Gansu Province became a phenomenon as a popular tourist destination due to its spicy hotpot, while Kaifeng in Henan Province gained fame as a trending tourist spot after a matchmaker in the city went viral on social media. According to the index tracking hot tourist destinations compiled by the SIC, the reading for Tianshui and Kaifeng increased, respectively, by 201.3 percent and 92.6 percent year on year in March.

“Of particular note is the stronger consumption in markets in smaller cities,” Bank of China’s chief researcher Zong Liang said at the forum. “This demonstrates the ongoing simultaneous upgrading of China’s consumption at multiple levels, which is a significant driver of economic growth.”

“The scale of imports and exports has seen a relative rebound compared to last year,” Zhang Yu, a researcher with the National Academy of Economic Strategy of the Chinese Academy of Social Sciences, told the forum.

In Q1, China’s exports and imports of goods rose 5 percent, according to the NBS. Through surveys and investigations, we found import and export enterprises have reflected a considerable improvement in the volume of active orders compared to last year, Zhang said.

“The trend of structural upgrading in imports and exports continues to be maintained and further strengthened,” Zhang said. Since last year, electric vehicles (EVs), lithium-ion batteries and photovoltaic products have played a significant role in supporting China’s exports. This year, mechanical and electrical products continue to play a prominent role in export products. Particularly, exports of some ship-related products are experiencing rapid growth.

However, Western leaders and media have recently voiced concerns over risks to global markets posed by “Chinese overcapacity” in EVs and solar panels, saying it could wipe out overseas industries. In response, Zhang told Beijing Review that while airing these concerns, critics should also reflect on whether there is an excess of U.S. dollars in global circulation.

Zhang explained the accumulation of production capacity is a market-driven process that arises from demand. China’s accumulation of production capacity is a result of absorbing huge global demands.

“The West is criticizing China for overcapacity in EVs, but why don’t they mention their overcapacity in traditional fuel vehicles? It’s because the West has a technological advantage in traditional fuel vehicles while China has the advantage in EVs thanks to technology, local supply chains, brand-new transport infrastructure, and lower energy and land costs,” Zhang said.

Zhang also affirmed the role of multilateral mechanisms such as the Belt and Road Initiative, the Regional Comprehensive Economic Partnership (RCEP) free trade agreement and BRICS in promoting trade, and praised the export-import performance of private enterprises in the first three months.

As the timing and scale of U.S. Fed’s interest rate cuts remain uncertain and global geopolitical conflicts continue to occur, these factors will continue to have an impact on foreign trade in the future, Zhang said.

Future of quality development

“Despite the promising start, it is important to recognize the increasing complexity, severity, and uncertainty of the external environment,” Sheng emphasized. “The foundation for economic stability and improvement is not yet firmly established.”

As a next step, China needs to foster the development of new quality productive forces, intensify the implementation of macroeconomic policies, enhance economic vitality, prevent and resolve risks, raise expectations, consolidate and enhance the positive momentum of economic recovery, and continuously promote the qualitative and efficient improvement and reasonable growth in the economy, he said.

The country remains in a phase of structural adjustment, transformation and upgrading. Some enterprises will have to endure the pains of transformation. As traditional industries adjust and new growth drivers are cultivated, it is normal to experience some fluctuations in economic growth. However, the continuous improvement in quality and the ongoing progress in high-quality development are the fundamental factors driving the positive momentum of China’s economic recovery, Sheng said. –The Daily Mail-Beijing Review news exchange item