By Ali Imran

ISLAMABAD: Finance Minister Ishaq Dar warned Moody’s Investor Service on Friday that he would give a “befitting” reply in a meeting with its officials next week if the agency did not reverse the downgrade of Pakistan’s sovereign credit rating.

“They (Moody’s officials) have to meet me. I told them if you don’t [reverse] this, I will give you a befitting response in our meeting next week,” he said.

A day earlier, Moody’s cut Pakistan’s sovereign credit rating by one notch to Caa1 from B3, citing increased government liquidity and external vulnerability risks, following the devastating floods that hit the country earlier this year.

“The outlook remains negative,” said the New York-based rating agency, adding that the floods had exacerbated Pakistan’s liquidity and external credit weaknesses and vastly increased social spending needs, while government revenue is severely hit.

Debt affordability, a long-standing credit weakness for Pakistan, will remain extremely weak for the foreseeable future. The downgrade has pushed the country into the C-cate¬gory after seven years, i.e. March 2015.

Talking outside an accountability court in Islamabad yesterday, Dar said he had spoken to the agency’s officials and told them that they “should not have done it”.

Moody’s should have consulted Pakistan prior to the downgrade, the finance minister said, adding that there was “no cause for worry” as rating agency Fitch had also downgraded the United Kingdom earlier this week.

“The main work of these rating agencies is related to bonds. We floated $500 million bonds in April 2014 and we had 14 times oversubscription.

“We have given our response. I have worked in international organisations too. It was impossible for them (Moody’s) to undo [the downgrade],” he acknowledged, but reiterated that he would give a “befitting response” to the agency.

Moody’s said its Caa1 rating reflected its view that Pakistan will remain highly reliant on financing from multilateral partners and other official sector creditors to meet its debt payments, in the absence of access to market financing at affordable costs.

It expected Pakistan’s ongoing IMF programme to remain in place and provide an avenue for financing from the lender and other multilateral and bilateral partners in the near term.

Moody’s said Pakistan’s weak institutions and governance strength added to the uncertainty whether the country will maintain a credible policy path that supports further financing. The negative outlook also captures risks that, should a debt restructuring be needed, it may extend to private sector creditors.

The Caa1 rating also applies to the backed foreign currency senior unsecured ratings for the Third Pakistan International Sukuk Co Ltd and the Pakistan Global Sukuk Programme Co Ltd. The associated payment obligations are, in Moody’s view, direct obligations of the government of Pakistan.

Concurrently, the Moody’s also lowered Pakistan’s local and foreign currency country ceilings to B2 and Caa1 from B1 and B3, respectively. The two-notch gap between the local currency ceiling and sovereign rating is driven by the government’s relatively large footprint in the economy, weak institutions, and relatively high political and external vulnerability risk.

Moody’s also forecast inflation to pick up to 25-30pc on average for fiscal 2023, compared to a pre-flood estimate of 20-25pc.

The government said Moody’s carried out rating action “unilaterally without prior consultations and meetings with teams from the Ministry of Finance and State Bank of Pakistan”.

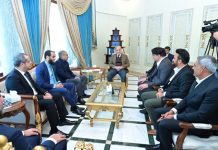

Following Moody’s action, the finance ministry held two meetings with the agency’s team over the past 24 hours, sharing data and information which clearly show a picture contradicting Moody’s rating action.

The ministry said the “government policies over the last few months have helped in fiscal consolidation” and the government had adequate liquidity and financing arrangements to meet its external liabilities. The continuation of the IMF programme was based on the confirmation and confidence in country’s ability to maintain the fiscal discipline, debt sustainability and its ability to discharge all its domestic and external liabilities, it said.

It said Moody’s estimates translating economic losses into fiscal deficit was also contested as uptick in urgent current expenditure is being met through re-allocations and re-appropriations of budgeted funds thus mitigating the risk of rising deficit. On the revenue front, the increase in nominal GDP is likely to compensate for any dip in revenues.

“The impression of restructuring of Pakistan’s debt is refuted unequivocally as currently no such proposal is under consideration or is being pursued as has been categorically stated by the finance minister,” it said.