Staff Report

ISLAMABAD: The Economic Coordination Committee (ECC) of the Cabinet on Wednesday after a detailed discussion approved the execution of the settlement agreement of the Roosevelt Hotel, New York with the Hotel Union and the New York City Government.

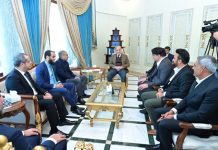

The ECC met here with Minister for Finance and Revenue Senator Mohammad Ishaq Dar in chair discussed a summary submitted by the Ministry of Aviation on Challenges and re-opening of Roosevelt Hotel, New York, and briefed the meeting on the outcome of negotiations held by the Committee with the New York City Government and the Hotel Union on reaching a suitable agreement for utilization of the Roosevelt Hotel (1,025 rooms) over a period of three years for Immigrant Housing Business by the New York City Government.

The ECC further gave node for withdrawal of pending lawsuits by the Roosevelt Hotel with the Hotel Union and the City of New York pursuant to the terms of the settlement agreement with the Union.

The ECC further directed the PIAL to engage and share its business plan with the National Bank Pakistan regarding the rollover of loans, said a press release.

The ECC also approved Technical Supplementary Grants/Supplementary Grants of Rs153 million in favour of the Ministry of Water Resources for payment of court cases fee for the settlement of the dispute with India under the Indus Waters Treaty.

The Technical Supplementary Grant of Rs 4 billion (Equivalent to US$ 20 million) as Rupee cover in favour of the Ministry of Federal Education and Professional Training for the World Bank Program “Actions to Strengthen Performance for inclusive and responsive education was also approved.

The meeting was attended by Minister for Power Khurram Dastgir Khan, Minister for Industries and Production Syed Murtaza Mahmud, Minister for Climate Change Senator Sherry Rehman, Minister for Aviation/Railways Khawaja Saad Rafiq, Shahid Khaqan Abbasi, Minister of State for Finance and Revenue Dr Aisha Ghous Pasha.

Special Assistant to Prime Minister Finance Tariq Bajwa, SAPM on Revenue Tariq Mehmood Pasha, federal secretaries and other senior officers also attended the meeting.

Meanwhile, Pakistan’s chances of clinching a long-suspended International Monetary Fund (IMF) bailout — decisive to dodge an impending debt default — have been likely reduced to ‘prayers’ as the country burns after Pakistan Tehreek-e-Insaf (PTI) leader Imran Khan’s arrest, analysts said Wednesday.

Violent clashes between supporters of Imran Khan and police broke out across the country after National Accountabil-ity Bureau (NAB), the country’s premier anti-graft agency, arrested the former prime minister on Tuesday.

The latest spike in Pakistan’s political temperatures comes as the nation prepares to hold tightly fought elections in the autumn while facing its worst economic crisis in decades, with dwindling reserves and a stalled $6.5 billion IMF pro-gramme that is expiring in June and scarce other financing sources in sight.

“With protesters on the streets, the IMF will be even more wary about restarting the loan deal,” said Gareth Leather, senior economist for Emerging Asia at Capital Economics (EACE).

The turmoil since Khan was ousted just over a year ago has scarred the country’s economy and markets.

Pakistan’s rupee has lost nearly 50% over the past 12 months. The main stock index has suffered a double-digit decline over the same period.

On Wednesday, the rupee tumbled to a fresh record low of 289.5 to the dollar. The country’s international bonds, al-ready in deeply distressed territory of as little as 32 cents, dropped more than 1 cent in the dollar on the day.

JPMorgan analyst Milo Gunasinghe said little relief from political uncertainty was in sight while the IMF programme remained stalled.

“The latest developments likely dampen any prospect of a political breakthrough across both sides,” Milo said.

The bank recently lowered its 2023 growth forecast for the country from 1.3% to 0.1% and warned of “stagflation shock” due to delays in the IMF talks, while the central bank hiked its key interest rate to a record 21% to fight double-digit inflation.

The nuclear-armed nation faces the risk of default unless it receives massive support. The gross public debt-to-GDP ratio stands at 73.5%, according to government data as of December. Foreign exchange reserves at $4.457 billion cover barely a month’s worth of imports.