By Asad Cheema

ISLAMABAD: Member of National Assembly (MNA) & Standing Committee on Finance and Revenue Mirza Ikhtiar Baig on Wednesday said to boost foreign reserves, efforts are required for raising FDI and exports, as remittances are already at a record-high level.

He was speaking, at a session titled, “Unlocking Debt and Development: A Layman’s Guide on Public Debt” organized by Sustainable Development Policy Institute (SDPI), said a press release.

He said that debt is not inherently negative, particularly when there is a viable plan for repayment and it is directed toward productive investments. However, in Pakistan, continuous rollovers have made the debt increasingly unsustainable. Now Pakistan borrows debt simply to repay previous loans.Pakistan’s cuisine

Baig referred to Fiscal Debt Limitation Act, debt-to-GDP ratio must be under 60%. He stated that the only way to make debt sustainable is by increasing income and foreign reserves

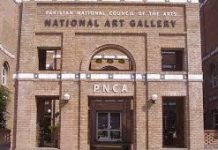

The Sustainable Development Policy Institute (SDPI) in collaboration with the Friedrich Ebert Stiftung (FES) commenced a three-day workshop, bringing together a diverse group of participants to engage in discussions on sustainable fiscal policies, tax reforms, and the long-term welfare of citizens.

Dr. Sajid Amin, Deputy Executive Director SDPI said, “The rising levels of public debt in developing countries have raised alarm bells across the region. With global debt levels reaching unprecedented heights, developing nations are facing mounting pressures, with 91 low and middle-income countries at risk of debt distress or default”.

Abdullah Dayo, Program Manager FES highlighted that vicious cycle of increasing debt levels coupled with low revenue collection leads to the cutting of essential public services, inflationary pressures, and higher living costs for citizens.

Although Pakistan’s constitution empowers parliament to set debt limits, current levels of debt have far surpassed the statutory ceiling of 60% of GDP set by the Fiscal Responsibility and Debt Limitation Act (FRDL) of 2005.

Dr. Ali Salman, Executive Director PRIME says both in the short run and in the long run, public external debt has a negative and significant relationship with per capita GDP and investment in Pakistan. The domestic debt also has a negative and significant relationship with investment.

Mohsin Mushtaq Chandana, Director General Debt Management, Ministry of Finance, says that GDP has increased in proportion with inflation.

Pakistan economy has stabilized because of reducing interest rates. If the debt of a country exceeds 90%, it drags GDP growth by 1% merely, mainly due to increase in interest expense.

Ministry of Finance needs to raise a larger proportion of domestic borrowings through long-term securities with maturities of 10 years or longer to improve its average time to maturity, and reduce gross financing needs.

A first of its kind, three day workshop aims to improve debt literacy amidst rising public debt & tax injustice in South Asia, with focus on Pakistan.

The objective is to foster well-informed dialogue and analyses around public debt and development.