From Zeeshan Mirza

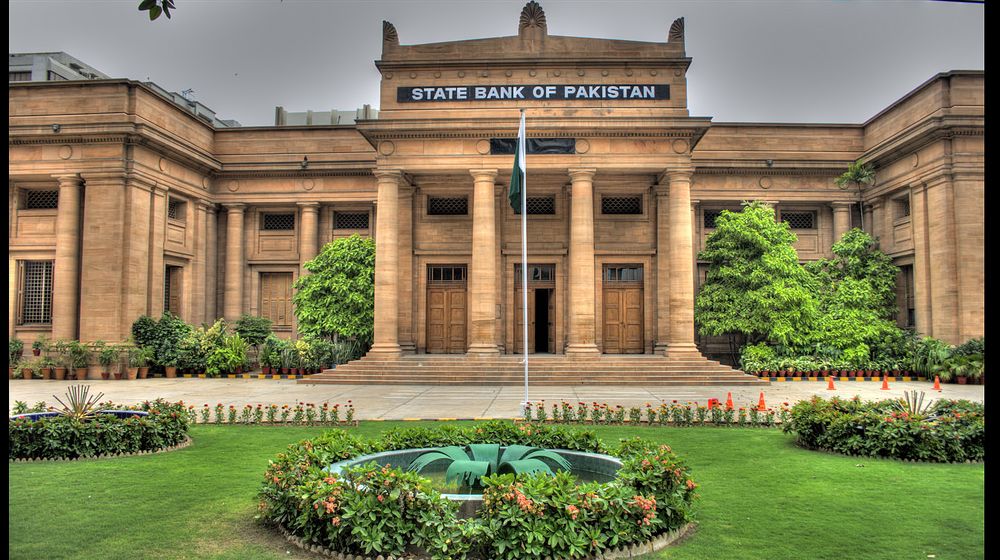

KARACHI: Pakistan’s foreign exchange reserves, held by the State Bank of Pakistan (SBP), hit a two-year high at $9.4 billion as they jumped nearly half a billion dollars on the back of “official inflows”, ac-cording to the central bank data released on Thursday.

“During the week ended June 28, 2024, SBP’s reserves increased $494 million to $9.39 billion due to official inflows from multilateral agencies,” the SBP said in a statement. The reserves have now soared back to the July 2022 level, which can finance almost two months of imports.

However, the foreign currency reserves held by commercial banks dropped $128 million to $5.18 billion in the week ended June 28.

Accordingly, the total foreign currency reserves held by the country surged a net $365.7 million to a one-month high at $14.57 billion.

In the prior week, the reserves had dipped below $9 billion “due to external debt repayments”, after staying above the threshold for seven successive weeks.

In the meantime, the central bank has continued to make hefty purchases of US dollars from the mar-ket to maintain the country’s reserves at adequate levels. At the same time, robust inflows of work-ers’ remittances and improvement in export earnings in FY24 also played a key role in propping the foreign currency reserves.

The SBP’s reserves have reached current levels from less than $4 billion in June 2023, partly supported by $3 billion in assistance from the International Monetary Fund (IMF) and $3 billion worth of deposits by the United Arab Emirates (UAE) and Qatar in the central bank in June and July 2023.

Despite the surprising increase in central bank’s reserves, the Pakistani rupee continued to remain un-der pressure against the US dollar for the third consecutive day.

The local currency lost Rs0.10 on a day-on-day basis, closing at Rs278.50 against the greenback on Thursday. So far, it has shed a total of Rs0.16 in the first three days of the new fiscal year 2024-25.

The currency came under pressure in the backdrop of rising global energy prices and speculation that the rupee would depreciate before a new IMF loan programme of over $6 billion was awarded to Paki-stan by the end of July.

In the previous fiscal year, the rupee appreciated for the first time in three years, rising by 2.75% to Rs278.34/$.

The government’s strategy to keep a tight control over imports to protect the thin reserves and miti-gate the risk of default on foreign debt helped the rupee-dollar parity to stay stable in FY24, mostly in the second half of the year.