ISLAMABAD: Investments in Pakistani startups slowed markedly in the fourth quarter of 2022 with the yearly investments just marginally exceeding the money raised in 2021.

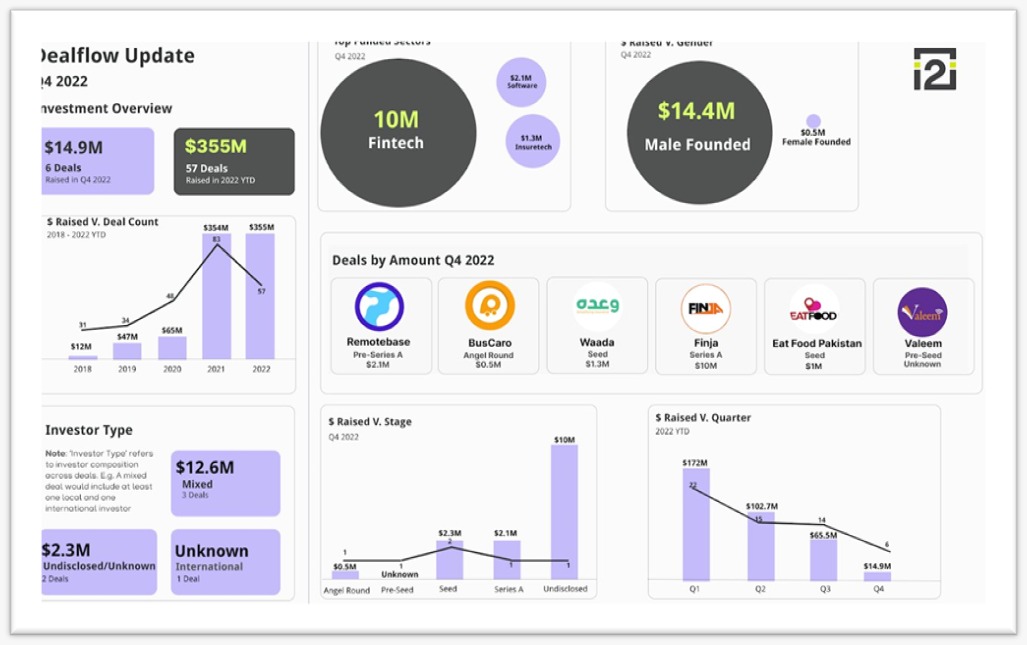

According to the data shared by Invest2Innovate (i2i), a startup consultancy firm, Pakistani startups raised $355 million in 2022 compared to $354 million in 2021, registering a growth of just 0.28%, as 57 deals were done in 2022 compared to 81 in 2021.

The data shows that in Q4-2022, Pakistani startups raised $14.9 million across six deals, bringing the total to $355 million throughout the year. However, the amount raised in Q4 of 2022 was down 77% from Q3-2022, and down 91% from Q1-2022. The last quarter of 2022 saw a 79% reduction compared to Q4 of the previous year.

The data shows that till the third quarter of 2022, the startups were growing at a good pace. In the first three quarters of 2022, the volume of investments stood at $340 million, which was 22% higher than the first three quarters of 2021. However, the fourth quarter of 2022 saw a plunge.

In October 2022, Remotebase, a software development firm, raised $2.1 million in pre-series A round. In November, BusCaro – a transport solution startup – raised $0.5 million in angel round. Waada – an insur-tech startup – raised $1.3 million in seed round, and Finja – a fintech startup – raised $10 million in series-A round.

The i2i data shows in December, Eat Food Pakistan raised $1 million in seed funding and Valeem raised an unknown amount in pre-seed funding.

The data shows that fintech startups remained at the top by raising $10 million followed by software development startups, which raised $2.1 million, while insur-tech startups raised $1.3 million.

In terms of gender, male-founded startups raised $14.4 million across five deals, while a female-founded startup (BusCaro) raised $0.5 million across a single deal. There were no female co-founded companies in Q4 2022.

Talking to WealthPK, Hamza Saeed, director of strategic planning and client services in Special Technology Zones Authority (STZA), said funding for startups is decelerating in Pakistan due to a global phenomenon rooting from Silicon Valley. “Rate hikes in Europe and US to deal with global inflationary pressures, and supply chain bottlenecks due to Russia-Ukraine crisis have contributed to the lower level of investments in startups. However, Pakistan has enormous potential to grow in the startup ecosystem.”

He said founders of startups are expected to perform better in terms of business plans, financial modelling and pitching to raise venture capital funds.

Hamza Saeed said flow of money into startups was healthy the previous year. “However, there has been a marked slowdown in deal flow in 2022 due to various regional and global developments.”

The startup ecosystem was impacted by external factors more than ever during the outgoing year, mirroring the macroeconomic challenges the world was facing, he explained.

Hamza Saeed said in November 2022, Pakistan’s year-to-year inflation climbed to a decades-high of 23.84%. Additionally, the State Bank’s reserves rapidly depleted with a decline of $11.6 billion in 2022 with the total reserves hitting an eight-year low at present, barely enough to cover one month’s imports, he added.