ISLAMABAD: Investment holding companies are becoming more important in today’s world, especially in Pakistan, where big business groups like Engro, Packages, DH Corp, and TPL are creating their own such companies, reports WealthPK.

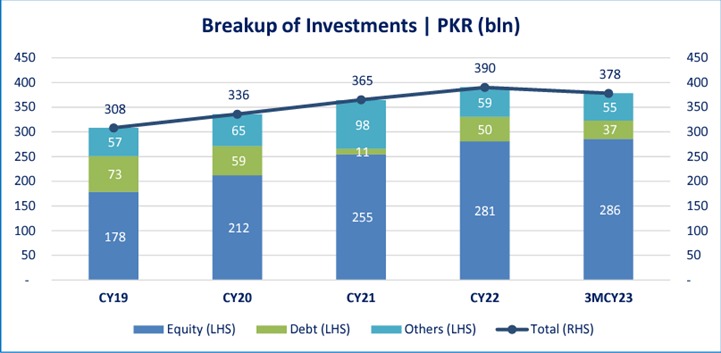

A report by the Pakistan Credit Rating Agency (PACRA), available with WealthPK, says cumulative investments in the sector reached approximately PKR390 billion by the conclusion of December 2022, indicating a growth of about 6.8% compared to PKR365 billion observed at the conclusion of December 2021.

During the first quarter of the Calendar Year 2023, investments totalled around PKR378 billion, in contrast to PKR 354 billion recorded in the same period of the previous year.

The practice of establishing holding companies (HoldCos) to oversee conglomerate structures is a firmly established phenomenon in Pakistan. This is evident in the operations of prominent business conglomerates such as E.Corp, DHCorp, Packages, JS & Co., and IGI, among others. Within this sector, a well-organized framework is in place, supported by a substantial asset base and investment portfolio, valued at approximately PKR390 billion and PKR392 billion, respectively, as of the conclusion of December 2022.

In terms of investment market share, the E.Corp comprised the largest portion in the sector, accounting for roughly 26% of the investment portfolio by the end of December 2022 (a slight decrease from approximately 27% at the close of December 2021).

Following closely is Hub Power Holdings, constituting around 24% of the portfolio by the end of December 2022, compared to approximately 19% by the end of December 2021. The aggregated assets of the sector amounted to PKR401 billion by the conclusion of March 2023, compared to PKR392 billion at the close of December 2022.

Concerning debt investments, cumulative investments of holding companies reached PKR50 billion by the end of December 2022, displaying a substantial year-on-year growth of approximately 354% (compared to PKR 11 billion at the close of December 2021).

This growth is predominantly attributed to the government securities, which constitute approximately 92% of investment and expanded by roughly 479%, along with a smaller portion (around 8%) of other debt investments, including mutual funds.

The distribution of investments in the sector, as of the conclusion of December 2022, is predominantly allocated to the power generation sector (comprising approximately 56% of the investments) and other sectors (constituting approximately 23%).

These other sectors encompass a variety of industries such as real estate, insurance & banking, investment services, and information technology, among others.

The sector demonstrates robust capital formation and equity strength, providing the necessary financial backing for subsidiary entities and strategic investments.

Given that a significant portion of the country’s major business groups maintain investments across diverse sectors and numerous companies, the establishment of holding companies is imperative for effective management, stringent financial control, and realization of synergies throughout the group’s operations. –INP