ISLAMABAD: The continuous hike in the US interest rate as part of Washington’s so-called campaign to combat high inflation threatens a major global recession, say economic experts.

Speaking to WealthPK, Dr Malik Saqib Ali, Head of the Economics Department at the Islamabad-based National University of Modern Languages (NUML), said the hike in the interest rate had raised the cost of credit in general and auto loans in particular, which could trigger recession.

“Interest rates increase the cost of loans for businesses and consumers, and everyone ends up spending more on interest. The world’s big economies are also hit hard by the Fed hike in policy rates due to which many companies may not be able to grow because of high interest rates,” Dr Saqib said.

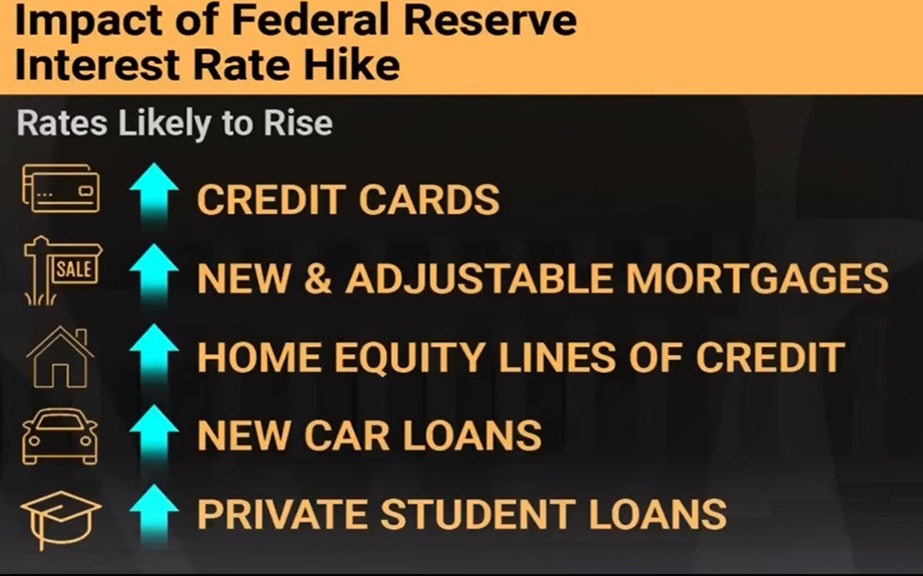

This is the most front-loaded interest rate hiking cycle in decades. Additionally, the rising interest rates affect the stock and bond markets, credit cards, student loans, auto loans, and business loans, Saqib explained.

Talking to WealthPK, Dr Zahid Mehmood Akhter, Associate Professor of the Economics Department at NUML, said the Fed rate hikes impact both developed and developing countries’ stock markets.

“Higher costs and lower business can negatively impact the public companies’ revenues and earnings, affecting their growth rate and stock value. Furthermore, the Fed’s rate hike has impacted other emerging financial markets around the world, with numerous currencies losing their value against the dollar,” Dr Zahid said.

The global big economies have also been hit hard by the fed hike in policy rates. India is likely to raise interest rates two times more this year. The Philippines central bank has also raised the key interest rate by 25 basis points to 2-point-5 percent. Latin America countries are also on the same track. Mexico has increased its benchmark interest rate by record 75 basis points to 7-point-seven-five percent. Developed countries in Europe are no exception. The UK interest rates rose further last month (September) from 1 percent to 1-point-two-five percent, as the Bank of England attempts to stem the pace of soaring consumer prices.

The European Central Bank reiterated its intention to raise interest rates in July and September this year. Meanwhile, there’s a possibility that South Korea might also increase interest rates in the coming months as the currency volatility remains.

If a recession sweeps through most large economies, the US economy may also suffer.

Economist Nouriel Roubini recently predicted that “many zombie institutions, zombie people, corporations, banks, shadow banks, and zombie countries will perish” as interest rates rise.

Roubini also predicted that the global debt levels will cause stocks to fall throughout bull and bear markets and that the Federal Reserve’s goal of achieving 2% inflation without a harsh landing will be “mission impossible.”

Depending on how severe the supply shocks and financial hardship would be, Roubini anticipated that the US and worldwide recessions will last the entire 2023. Banks and households were also hit hard by the 2008 financial crisis. He predicted that corporations and shadow banks like credit funds, hedge funds, and private equity firms “are going to implode” this time.

According to the Federal Reserve Open Market Committee (FOMC), policy rate increases might reach 3.8% in 2023 and 3.4% in 2024. GDP growth estimates for the US economy were lowered from 2.8% & 2.2% in March to 1.7% in 2022 and 2023.

Mr Muhammad Haroon, Associate Professor and Coordinator Economics Department at the NUML, told WealthPK that countries around the world raise interest rates following the Fed’s rate hike, causing people to change their budgets to buy houses with high mortgage rates.

He said the Fed rate hike might lead to global stagflation in near future. The lowest-income households are particularly hard hit by stagflation, which is characterized by slow growth, unemployment and excessive inflation, he added.

Globally, employers with labour market power are more likely to terminate workers as interest rates rise because they can simply hire again when interest rates lower, Haroon said.