———– Says economy moving towards stability

———– Acknowledges relief in electricity bills, POL prices

———– Adds “govt believes in passing benefits to common man”

———– Asserts int’l financial bodies have acknowledged Pakistan’s positive economic indicators

By Anzal Amin

ISLAMABAD: Expressing satisfaction over the “nosediving of inflation rate” in the country, Prime Minis-ter Shehbaz Sharif has said that the economy is moving towards stability owing to the hard work of the government’s financial team.

C iting the details shared by the Pakistan Bureau of Statistics (PBS), the prime minister said on Sunday that the ‘Consumer Price Index’ fell to record low in July 2024, bringing inflation to 11% and welcomed the forecast of further decline in the inflation rate in the current month of September.

Meanwhile, the Ministry of Finance — in its monthly outlook report — stated that on account of stabil-ity in economic indicators, inflation is expected to remain within the range of 9.5-10.5% in August and further decline to 9-10% in September. “After Fitch, the global rating agency, Moody’s recently upgraded Pakistan’s credit rating, which is an acknowledgement of the country’s positive economic indicators by the international financial institu-tions,” the PM Office Media Wing, in an official statement, quoted the premier as saying.

The government is pursuing a policy of economic reforms and the implementation work is rapidly in progress over the rightsizing policy of the government which the premier himself is monitoring, ac-cording to the communique.

PM Shehbaz also expressed the confidence that its positive impact on the economy would be visible soon.

At the same time he also acknowledged that the federal and Punjab governments had provided a big relief to the electricity consumers in respect of monthly bills, adding the prices of petroleum products were further reduced from today.

The Pakistan Muslim League-Nawaz (PML-N)-led government announced a reduction of Rs14 per unit in the electricity tariff for August and September under a power subsidy plan for consumers using 201 to 500 units.

The premier said that the government believed in passing on all the benefits of such policies to the common man. “The government is cognizant of the issues of the people and was striving day and night to resolve them,” he added.

Earlier in August, Moody’s Ratings upgraded Pakistan’s local and foreign currency issuer and senior un-secured debt ratings to Caa2 from Caa3 owing to improvement in macroeconomic conditions.

“We have also upgraded the rating for the senior unsecured MTN programme to (P)Caa2 from (P)Caa3. Concurrently, the outlook for the Government of Pakistan has changed to positive from sta-ble,” the rating agency said in a statement.

Accordingly, Pakistan’s default risk has reduced to a level consistent with a Caa2 rating, as per Moody’s. “There is now greater certainty on Pakistan’s sources of external financing, following the sovereign’s staff-level agreement with the IMF on 12 July 2024 for a 37-month Extended Fund Facility (EFF) of $7 billion.”

The release of the International Monetary Fund’s (IMF) latest schedule is a significant development, but the absence of Pakistan’s loan approval on the agenda is a cause of concern as it is critical for the country to secure the loan to shore up its sinking economy.

On the other hand, the government remained optimistic that the country will secure approval for a $7 billion bailout package from the IMF next month, sources privy to the matters told Geo News earlier this week.

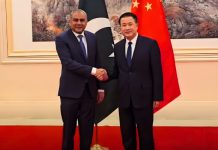

Finance Minister Aurangzeb last week also dismissed concerns about the IMF declining the staff-level agreement, exuding confidence that “the lender will approve it next month”.

Pakistan and the global lender had reached an agreement on the 37-month loan programme in July.

The IMF said the programme was subject to approval from its Executive Board and obtaining “timely confirmation of necessary financing assurances from Pakistan’s development and bilateral partners”.