-PKR plunges to historic low of 225 against USD

-PTI criticizes govt over Rupee’s downfall

-Miftah says strategy evolved to level imports with exports and remittances

By Anzal Amin

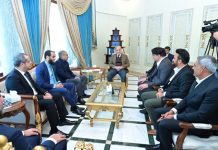

ISLAMABAD: The rupee continued its fall in the interbank market on Wednesday, with the local currency closing at a historic low of Rs225 against the dollar as Finance Minister Miftah Ismail said political turmoil was to blame for the downturn.

“The panic in the market is primarily due to political turmoil, which will subside in a few days,” Ismail told media, adding that he expected pressure on the rupee to fall in the next few days.

Analysts attributed the decline to the lack of economic guidance amid the political uncertainty prevailing in the country and the State Bank of Pakistan (SBP) not intervening.

According to the SBP, the rupee closed at Rs224.92 against the dollar, down Rs2.93 or 1.3 per cent, from Tuesday’s close of Rs221.99.

Mettis Global Director Saad bin Naseer said the freefall in the rupee’s value was continuing because the markets were without economic guidance amid the evolving political situation.

“For the market to stabilise, it will require some form of guidance on the political front from the PTI or the ruling coalition with respect to elections.” He was referring to the PTI’s victory on at least 15 of the 20 Punjab Assembly seats, on which by-polls were held on July 17. Following the win, the PTI has claimed that incumbent Punjab Chief Minister Hamza Shehbaz has no justification to remain in the province’s top office, and at the same time is demanding fresh general elections.

Former Foreign Minister and Pakistan Tehreek-e-Insaf (PTI) Vice-President Shah Mehmood Qureshi has criticized the coalition government over rupee devaluation, saying that the current regime only wants to complete its tenure.

In a statement, the former federal minister claimed that the current rulers want to complete their tenure by force, while the country’s economy was deteriorating.

“The government doesn’t care about the country’s economy. The rupee is continuously depreciating, which will bring a new storm of inflation. However, the government has not taken any step in this regard,” he added.

Meanwhile, Miftah Ismail said that government had taken result-oriented measures to level imports with exports and remittances. “We are trying to bring imports almost equal to exports and remittances.

Because we do not have space in foreign exchange reserves to reduce these and we also do not have other reserves. So we want to strike balance between imports exports and remittances,” the federal minister said while addressing a press conference Wednesday.

The minister said that soon after assuming the power, the government initiated measures to reduce imports and it achieved success in June when the non-energy import bill reduced by 15%.

However, he added, the energy imports increased due to price-hike in international market and import bill surged by 120% last month. He said, there were imports of $7.4 billion last month including $ 3.7 billion energy and $3.7 billion other imports.

He said, the government had taken many measures including improving LC margins, banning assembled vehicles and mobile phones. It also reduced speed of local manufacturing of cars, vehicles and fridges. It also made it mandatory for $1 lac LC to get permission from State Bank of Pakistan.

All this worked and bore fruit as till July 18, there were only $2.609 billion imports, indicating that there would not be more than 5.5 billion imports throughout the month. Last month it was $7.5 billion, so 2 billion was reduced. The current account deficit would also reduce, he said.

The minister said, last year there was $48 billion trade deficit and $17 billion current account deficit, which is not affordable for Pakistan. However, it is encouraging that the measures the government had taken helped reduce imports.

He said when diesel was sold on subsidy, many dealers had hoarded the commodity for their benefit and currently there were around 60 days diesel against usual 8 days. So there would be less import demand, hence energy imports would reduce. Likewise, fuel prices have also moderated in the international market and have impact on country’s imports.

He said, the economic fundamentals of trade have been corrected as imports are almost equal to remittances and exports. There is little CAD, which could be financed.

The minister said, the Extended Fund Facility agreement with International Monetary Fund was on track and there was no issue that could halt it. He said Pakistan had already met all the prior requirements for the fund. He said the loan money would be transferred after formal approval by IMF board.

He said, this would open up financing from World Bank and Asian Development Bank and bring bout billions of dollars in the country.

He said, IMF was of the view $4 billion funding gap still existed which he said would be bridged by many sources as one of a friendly country had offered $1.2 oil financing, which would be finalized within a couple of days.

Likewise, another country would invest $1 to $2 billion in Pakistan Stock Exchange (PSX) whereas another country had promised $200 to $300 million gas on deferred payments.

In addition, he said, another friendly country offered $2 billion deposits and yet another friendly country would provide 2 billion SDRS (more than $2 billion)

Talking about the depreciation of rupee, the minister said that the local currency had depreciated against dollar whereas it had strengthened against Pound, Euro and Japanese Yen. He said, dollar has witnessed 22 years high appreciation against all currencies.

He however admitted that the current political situation in the country was one of the reasons for rupee depreciation.

In fact the minister while quoting SBP said that in terms of real effective exchange rate the rupee has depreciated by 3 percent since December keeping in view inflation.

The minister said that overall the economy was performing well. The revenue collection was witnessed at Rs751 billion during the month of June 2022, a 30 percent increase while the government also paid Rs40 billion DLTL and Rs35 billion to exporters. The Large Scale manufacturing was also well on track.

He expressed government’s resolved to enhance tax to GDP ratio in addition to bringing down budget deficit within couple of months.

He said, the government incentivized agriculture sector to enhance wheat production. He said the government had purchased 5 million tons of wheat and allowed import of 3 million more tons to build strategic reserves.

Likewise, it imported 0.2 million tons of urea at lowest rate of @ $500. The minister said, decision to export excessive sugar would be taken after consulting Sugar Advisory Board.