By Eman Alam

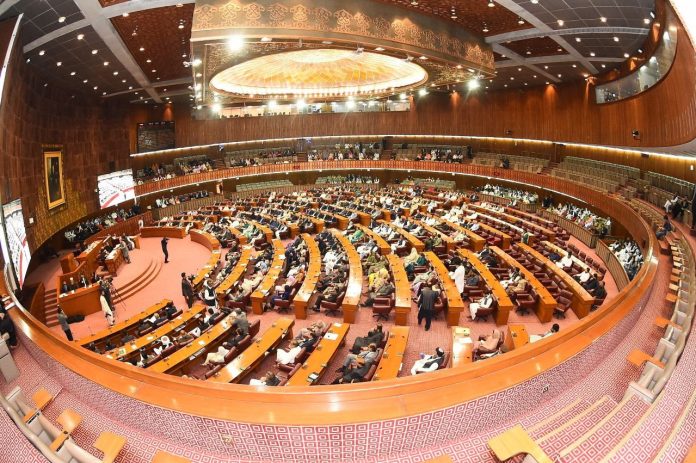

ISLAMABAD: The Senate Standing Committee on Finance rejected a proposal suggesting a ten-year jail term for individuals involved in tax fraud, media reported.

During the session, Senator Mohsin Aziz criticized the proposal, remarking sarcastically that it would be better to just impose life imprisonment.

He further noted that the Federal Board of Revenue (FBR) appeared to be equating tax fraud with the crime of murder.

FBR officials, while defending the proposal, stated that the punishment of 10 years’ imprisonment could be recommended specifically for cases where the amount of tax fraud exceeded Rs1 billion.

For frauds between Rs10 million and Rs1 billion, a five-year jail term was deemed appropriate, while for cases below Rs10 million, a minimum sentence should be considered.

The committee suggested setting punishments based on how much tax was stolen. Many members said that instead of long jail terms, smaller cases should be punished with fines.

The Chairman of the Committee asserted that individuals involved in tax fraud should be aware that the crime is punishable by imprisonment.

In response to criticism, the FBR Chairman said that if theft of a bicycle or motorcycle warrants jail time, then financial crimes involving public money should not go unpunished.

Senator Farooq H. Naik argued that if a judge has the power to sentence a person, they should also have the authority to order arrests. He advocated for revisiting the old law rather than introducing un-necessarily harsh new amendments.

The FBR Chairman said the current law is already very strict and can stay if Parliament agrees.

Finance Minister Muhammad Aurangzeb agreed, saying the old law is still in effect and the government wants to improve it further.

A heated exchange took place during the session as Senator Shibli Faraz accused government officials of using coercive tactics and trying to impose their will without consensus. He criticized their “my way or the highway” approach.

Minister of State for Finance Bilal Azhar Kayani assured the committee that the proposed amendment would be reintroduced after further deliberation.

He said keeping the old law would seem too harsh, so it’s better to improve it with sensible changes.

The committee concluded the session with the agreement to further discuss the controversial clause regarding arrest powers in the next meeting.