——– Defends salary hike for lawmakers, Ministers, NA and Senate custodians in post budget presser

——– Avers pensions and salaries are to be linked to inflation

——– Says Centre will work with provinces in Agriculture, livestock

——– Informs govt eliminated duties on 4,000 tariff lines, reduced on 2,700 in major trade reform

By Ali Imran

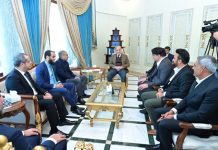

ISLAMABAD: Finance Minister Muhammad Aurangzeb has stressed the significance of tariff reforms proposed in the budget for the Fiscal Year 2025-26 (FY26).

“The tariff reforms have not been carried out for the last 30 years,” he said during a post-budget presser on Wednesday while highlighting that not only were they necessary for economic develop-ment but would also contribute towards an increase in exports.

The press conference, initially walked out by journalists due to not being given a technical briefing by the FBR on the federal budget as per tradition, comes a day after Prime Minister Shehbaz Sharif’s gov-ernment tabled its Rs17.57 trillion budget for FY26 setting a 4.2% GDP growth target and announcing relief measures for the salaried class while overall federal expenditure being slashed by 7%.

Projecting a deficit of 3.9% of the GDP, the budget expects inflation to be at 7.5% in the next fiscal year. Suggesting a 20.2% hike in the defence expenditure to Rs2,550 billion, the budget sets out an 18% more tax collection target of Rs14,131 billion — reflecting a 1.6% rise in tax-to-GDP ratio to 10.1%.

It also proposes new tax slabs for the salaried class — which has borne the brunt of the tax burden — with the minimum rate reduced to 4% from the existing 15% for taxpayers earning up to Rs2.2 million annually.

The tax rate for individuals making between Rs600,000 and Rs1.2 million a year will drop from 5% to 2.5%. Also, it suggests strict measures against non-filers to increase Pakistan’s tax net which, if approved, will leave non-filers locked out of the country’s financial system.

Briefing the media today, the finance czar elaborated on the tariff reforms, saying that the tariff has been brought down to zero on 4,000 tariff lines out of the total 7,000.

“The tariff reforms have not been carried out for the last 30 years,” he lamented while stressing the significance of tariff reforms proposed in the budget, saying that not only were they necessary for economic development but would also contribute towards an increase in exports.

Noting that pensions and salaries have to be linked to inflation, Aurangzeb said that the Centre would work with the provinces for the development of agriculture and livestock.

There should be a policy related to agriculture and livestock, he added.

The minister further stressed that there must be a clear benchmark. “Whether it is the public or pri-vate sector, it must be aligned with some benchmark,” he said.

He pointed out that across the world, salary and pension increases are typically tied to inflation benchmarks.

The finance czar announced that small farmers would be provided loans on easy terms, and assured that the government was making efforts to offer as much relief as possible.

He clarified that no additional taxes had been imposed on the agricultural sector in the new budget. However, he added, “We can only provide relief in accordance with our financial capacity”.

The minister noted that the current inflation rate remained at 7.5%. He emphasised the government’s responsibility to reduce federal expenditures, stating, “This time, we have limited federal expendi-tures to 2%”.

“Our budget starts with a deficit,” Aurangzeb admitted, while also acknowledging the historical trend of rising national debt. “In the past, our debts continued to increase”.

He justified certain increases in spending, saying they were necessary. “We have to move forward ac-cording to our means,” he said.

Commenting on the government’s overall fiscal approach, he stated, “Whatever the government is providing, it is doing so by taking loans.”

He further pointed out the government’s reliance on loans and borrowed money and defended the salary hike for the National Assembly speaker and Senate chairman.

“Look at when the salaries of ministers, ministers of state, and parliamentarians were last increased. The last increase in the salaries of cabinet ministers was in 2016,” Aurangzeb added.

Pointing out that globally non-profit organisations were not subjected to tax measures, Langrial said: “No organisation will be exempt from scrutiny in the future”.

“Institutions will have to prove that they are not working on a commercial basis,” he added.

“When non-profit organisations are not established for profit, then duty does not arise. We have compiled Tables One and Two for non-profit organisations. The FBR’s tax regime is based on self as-sessment,” the tax authority’s chief remarked.