As China prepared to implement its 15th Five-Year Plan (2026-30), the tone-setting Central Economic Work Conference (CEWC) convened in Beijing on December 10-11, 2025, to define the country’s economic direction and key priorities for 2026. In an exclusive interview with Beijing Review reporter Zhang Shasha, Cai Tongjuan, Vice President of and a research fellow with the Chongyang Institute for Financial Studies at Renmin University of China, explored the policy signals released by the meeting, how its plans lay a solid foundation for the start of the 15th Five-Year Plan and the potential opportunities they may create for the world economy. Edited excerpts of their conversation follow:

Beijing Review: What new policy signals did the CEWC send?

Cai Tongjuan: The conference emphasized that next year’s economic work should adhere to the principles of pursuing progress while maintaining stability and improving quality and efficiency.

For the first time, the conference called for leveraging the synergistic effects of existing and newly introduced policies while making macro policy orientations more consistent and effective, in order to strengthen synergy and avoid fragmentation of implementation.

At the top of the domestic demand agenda is a renewed emphasis on income growth and stability and revival of investment.

Adhering to the leading role of domestic demand and building a robust domestic market were ranked first among the eight priority tasks for the coming year. In a new policy move, the CEWC called for the formulation and implementation of an income growth plan for both urban and rural residents, directly targeting the fundamental engine of domestic demand. By strengthening income expectations, policymakers aim to provide consumption with a more sustainable and reliable source of momentum.

At the same time, more efforts are in the pipeline to stabilize and revive investment. The goal is to foster a virtuous cycle in which investment expands supply, supply generates demand and demand, in turn, supports further investment, thereby reinforcing the foundations of domestic demand.

Risk management is becoming more proactive and targeted. The task was changed from “effectively preventing and defusing risks in key areas” set out at the 2024 CEWC to “defusing risks in key areas actively and prudently,” reflecting a shift from passive defense to proactive intervention. In the property sector, the conference underlined the adoption of city-specific approaches in controlling new supply, reducing existing inventory and improving housing quality. This measure promotes buying housing stock (existing, unsold homes such as vacant apartments or units from struggling developers—Ed.) and converting them into affordable housing, aiming to stabilize the market while better aligning supply with demand.

The approach to addressing local government debt emphasizes proactive deleveraging and improved restructuring mechanisms. This signals that the Central Government will encourage local authorities to make more active use of market-based tools, including maturity extensions and interest rate reductions, to relieve debt pressures, particularly operating debts of local government financing vehicles, with the goal of tackling risks at their source.

In 2026, how can China better align the expansion of domestic demand with real economy growth? What specific policy tools are most effective for unlocking domestic consumption potential?

By placing “adhering to the leading role of domestic demand” at the top of the 2026 development agenda, the CEWC underscored the importance of the internal drive. This emphasis is particularly important amid rising external uncertainty, as domestic demand has become the central pillar for stabilizing economic performance. Meanwhile, the Fourth Plenary Session of the 20th Communist Party of China Central Committee’s focus on strengthening the real economy highlights the supply-side imperative of reinforcing manufacturing and foundational industrial capabilities. Together, these priorities form a dual-engine framework, with demand-side expansion and supply-side upgrading advancing in tandem.

Looking ahead, efforts to expand domestic demand must focus on boosting consumption, promoting more balanced development across urban and rural areas as well as across regions, and strengthening infrastructure investment, especially in the digital and green sectors. At the same time, improving social security systems will be essential to boosting household confidence and willingness to spend. Together, these measures intend to enhance the quality and sustainability of domestic demand, laying a solid foundation for steady and resilient economic growth.

How do the arrangements outlined at the CEWC lay the groundwork for achieving China’s economic development goals during the 15th Five-Year Plan period?

The conference’s policy agenda will play a foundational role in supporting China’s medium- and long-term economic transformation and upgrading. In the short term, measures aimed at stabilizing growth, preventing risks and securing employment for residents are designed to anchor economic fundamentals and prevent sharp fluctuations.

Over the medium to long term, the focus will shift toward innovation-driven and green development, alongside efforts to modernize industrial and supply chains. This approach reflects an integrated policy logic that balances near-term growth stabilization with the pursuit of high-quality development. It seeks to ensure steady and sound economic performance while building momentum for sustained and healthy growth.

By strengthening innovation capacity and reinforcing domestic demand as a key growth driver, the conference’s policy framework provides essential support for achieving main objectives for the 15th Five-Year Plan period, including industrial upgrading, green transition and the expansion of domestic demand.

China’s economic development faces multiple challenges. What concrete policy responses did the conference offer, and how can the country cope with external uncertainty by strengthening internal capabilities and shoring up the foundations for long-term growth?

The conference acknowledged that China’s economy is grappling with deep-seated challenges, including structural imbalances, mounting resource and environmental constraints, and heightened external uncertainty. In response, it outlined policy measures to reinforce resilience and reduce vulnerabilities.

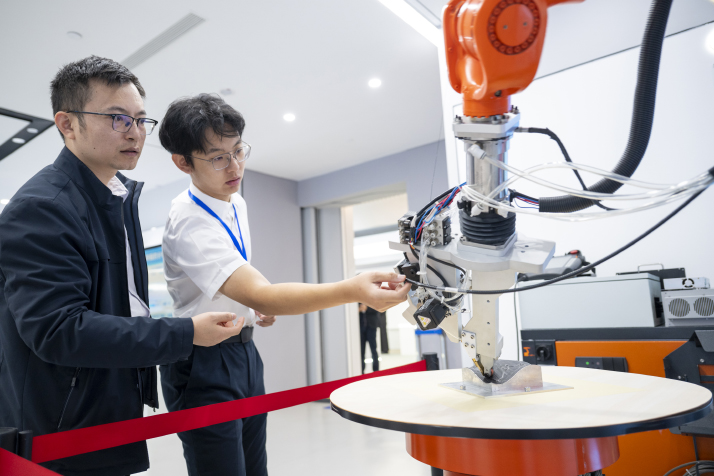

These include deepening supply-side structural reform to make China’s industrial and supply chains more self-supporting and risk-resilient, stepping up innovation to lessen reliance on external sources for critical technologies, improving macro-policy coordination to enhance overall economic stability and accelerating the green and low-carbon transition to bolster the sustainability of growth.

The call to strengthen internal capabilities points to a longer-term strategy. This means strengthening innovation capacity, creating a more efficient and predictable business environment, investing in talent development and advancing institutional reforms. Together, these efforts are intended to reinforce the economy’s internal impetus for development and its ability to withstand external shocks.

Based on the signals from the conference, what new opportunities might China’s growth create for the global economy?

The conference reaffirmed that China’s economy remains on a trajectory of long-term growth. Against the backdrop of a sluggish global recovery and heightened geopolitical complexity, China’s vast market, complete industrial system and growing innovation capacity continue to provide an important source of stability for the world economy.

China is working to strengthen the domestic economy and promote unimpeded domestic and international economic flows. In particular, a sustained focus on domestic demand is expected not only to reinforce internal growth drivers, but also to drive an upgrade in external demand, creating new opportunities for international trade and investment.

At the same time, the green and low-carbon transition, as well as the rapid development of the digital economy, are giving rise to new businesses, models and formats across sectors, attracting global capital and technological cooperation.

The stability and upgrading of the Chinese market support greater resilience and diversification across global value chains, positioning the country as an important growth pole for global economic recovery and innovation-driven development. –The Daily Mail-Beijing Review news exchange item