-Pakistan sign ‘Debt Service Suspension Agreements’ of $197.49 million G-20 Debt Service Suspension Initiative

By Anzal Amin

ISLAMABAD: Pakistan and the World Bank (WB) on Wednesday signed the agreement worth of $85 million for a house finance project to benefit the low- and middle-income households in Pakistan.

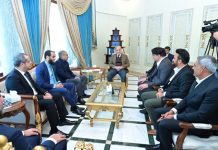

The Federal Minister for Economic Affairs, Sardar Ayaz Sadiq witnessed the signing ceremony of agreements of “Pakistan Housing Finance Project” (PHFP) worth of US$ 85 million with the World Bank at the Ministry of Economic Affairs Islamabad.

Mian Asad Hayaud Din, Secretary, Ministry of Economic Affairs Pakistan and Mr. Gailius J. Draugelis, Acting Country Director, World Bank signed the Financing Agreement while representatives of Pakistan Mortgage Refinance Company (PMRC) signed the Project Agreement.

The Acting Country Director, Mr. Gailius, ensured the World Bank’s continuous financial and technical assistance to the Government of Pakistan to help promote inclusive and sustainable economic growth in Pakistan.

While witnessing the signing ceremony, the Minister for Economic Affairs, reiterated the parameters of valued partnership with the World Bank.

He also stated that Wednesday’s event reflects continued confidence by the World Bank on the Government’s policy and programs.

He particularly announced that the primary beneficiaries of this project will be low- and middle-income households in Pakistan reliant on informal incomes.

The Pakistan Housing Finance Project is aimed at supporting the ongoing efforts of the Government of Pakistan in increasing access to housing finance for households and supporting capital market development in Pakistan. This additional financing will fund the initial capitalization of the sub-trust of the Risk Sharing Facility created under the parent project of US$ 140 million being executed by Pakistan Mortgage Refinance Company. The project will enable the Primary Mortgage Lenders (PMLs) to move from the very upper end of the households in the 5th quintile to lower quintile income groups.

Therefore, the financial sector at large will also benefit greatly as the project will help deepen the primary mortgage market, in addition to supporting the development of the capital market.

Separately, Pakistan has signed two ‘Debt Service Suspension Agreements’ on Wednesday amounting to suspension of loans worth USD 197.49 million, under the G-20 Debt Service Suspension Initiative (DSSI) frameworks.

According to the press release, the government of Pakistan has signed agreements with the Japan International Cooperation Agency (JICA) and the government of the Swiss Confederation under the G-20 Debt Service Suspension Initiative.

Of this total amount, USD 191.60 million were owed to JICA during the period from January to June 2021 and USD 5.89 million were owed to the Government of the Swiss Confederation during the period from July to December 2021.

These amounts will now be repaid over a period of six years (including one-year grace period) in semi-annual installments.

Due to the support extended by the development partners of Pakistan, including JICA and Government of the Swiss Confederation, the G-20 DSSI has provided the fiscal space which was necessary to deal with the urgent health and economic needs of the Islamic Republic of Pakistan.

The total amount of debt that has been suspended and rescheduled under the DSSI framework, covering the period from May 2020 to December 2021, stands at USD 3,688 million.

Pakistan has already concluded and signed 91 agreements with 21 bilateral creditors for the rescheduling of its debts under the G-20 DSSI framework, amounting to rescheduling of almost USD 2,953 million.

The signing of above-mentioned agreements brings this total to USD 3,150 million. Negotiations for remaining agreements to be signed under the G-20 DSSI are on-going.