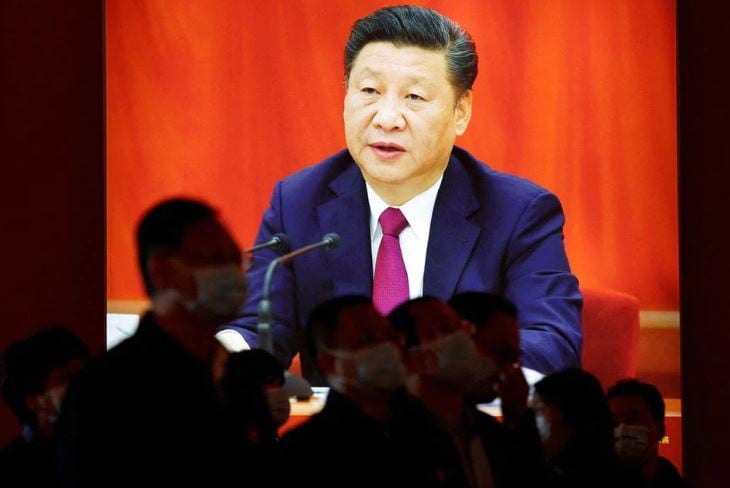

BEIJING: President Xi Jinping set forth key targets on Tuesday for the nation’s financial sector to follow a path of development with Chinese characteristics, stressing the need for the sector to better prevent and defuse risks and bolster institutional opening-up.

Xi, who is also general secretary of the Communist Party of China Central Committee, said the nation’s financial regulation must have “teeth and thorns” and remain sharp-edged.

He made the remarks while addressing a session on promoting the high-quality growth of the financial sector that was attended by provincial- and ministerial-level officials at the Party School of the CPC Central Committee in Beijing.

The session was held more than two months after the nation convened a tone-setting central financial work conference to outline plans for building up the sector.

Greater opening-up is needed to bolster the efficiency of and capacity for the allocation of financial resources and to build up the nation’s global competitiveness and influence in rule-making, Xi told the senior officials.

Institutional opening-up must be prioritized to further open the financial sector, he said, adding that the nation must align its financial regulations with rules in high-standard international economic and trade agreements, streamline restrictive measures and enhance the transparency, stability and predictability of opening-up policies.

The president highlighted the need to standardize investment and financing behaviors overseas and improve financial support for the joint building of the Belt and Road.

It is important to enhance the connectivity of domestic and foreign financial markets, make it easier for cross-border investment and financing, and actively take part in global financial regulatory reform, he said. The nation must guard the bottom line for financial security under the circumstances of opening-up, Xi added.

China has prioritized the financial sector in its broader efforts in recent years to widen access for foreign investors, introducing steps to scrap foreign ownership caps in the banking and insurance sectors and to slash access thresholds for foreign investors.

The outstanding loans in China’s banking system have exceeded 200 trillion yuan ($28 trillion), and the balance of social financing exceeded 300 trillion yuan, according to Pan Gongsheng, governor of the People’s Bank of China.

Pan wrote in an article last month that the risks in the nation’s financial sector have remained “manageable in general”, despite challenges such as financial chaos and corruption and weak financial regulatory and governance capabilities. The president reiterated on Tuesday the need for the financial sector to prioritize the prevention and defusing of risks, especially systemic risks, saying that financial regulatory authorities and industry regulators must clarify responsibilities and enhance cooperation.

Local authorities must perform their duties in risk disposal and maintaining stability, a process that involves zero tolerance for corruption as well as the prevention of moral risks, he said. –The Daily Mail-China Daily news exchange item